On a Saturday morning in early April, 20 people eager to buy homes gathered for a daylong class in the conference room at the town library in Bayfield, 20 miles east of downtown Durango.

One of them was Thomas Schleeter, who has lived in a camper in Bayfield for eight years. Schleeter, who works building custom hot rods, called housing prices in La Plata County “ridiculous.”

Another was electrician Trace Lovelace, who lives with his grandparents in Bayfield. He lost his lease when the owner decided to sell the property where he was renting a room. Lovelace hopes to buy a home with his girlfriend, who works for the county. He’s not optimistic.

“Even the affordable housing is over $2,000 a month,” he said.

For Dalton Labarthe and Cailyn Ainsworth, who are planning a wedding in the spring of 2026, they wanted property to build a home. Finding land to make that happen, though, has been a challenge. Labarthe works for a company that does excavations and other dirt work projects while Ainsworth runs a barbershop.

“We were looking at land, and the bank wants a 50% down payment,” Labarthe said. “It’s crazy.”

The April gathering drew prospective homeowners at the Pine River Library for a homebuyer education class hosted by HomesFund, a Durango-based nonprofit. Topics included “Budgeting and Debt Management,” “Credit 101,” “Real Estate Process,” “Mortgage Lending,” “Home Inspections” and “Home Maintenance.”

Instructor Hannah Flamm teaches a HomesFund homebuyer education class on Saturday, April 12, 2025, at the Pine River Library in Bayfield, Colo. Photo by Corey Robinson / Special to The Colorado Trust

After taking the class (which is open to anyone and requires no test to pass), the next step is thoroughly analyzing each applicant’s spending history and personal finance habits. HomesFund calls it a “homeownership assessment”—a deep-dive reality check on each potential homeowner’s wherewithal to take on the responsibility of a mortgage.

A green light from the financial review is also a prerequisite to becoming eligible for a HomesFund product called “shared appreciation loans.”

Over the past 14 years, HomesFund has helped 460 families and individuals buy homes by becoming a co-investor in their properties. Loans range from $15,000 to $125,000. Total investment in the loan program stands at $18.1 million.

The homeowner doesn’t make monthly payments on the loan. HomesFund takes its share of appreciation (the increase in the home’s value) when the home sells—whether that’s in two years or 20—or if there is a cash-out refinance or the home is no longer the borrower’s primary residence.

For example, if HomesFund loans $50,000 toward a $250,000 home purchase, the nonprofit takes 20% of the increased appreciation, a pro rata share of what was initially provided as down payment assistance. If a homebuyer purchases a $400,000 home but only qualifies for a $300,000 mortgage, HomesFund fills the gap with a $100,000 shared appreciation loan and takes a 25% stake in the house.

Ten years later, if the owner sells the property for $475,000, that person would then have to pay back the original $100,000 loan, plus 25% of the appreciation of the home ($18,750). The seller then receives the remainder of the net appreciation.

“One of the reasons we exist is because households are rent-burdened, making it incredibly difficult to save money for a down payment,” said Pam Moore, executive director of HomesFund. “And if you can’t save money, you can’t take the next step into homeownership. When you’re paying 45% of your income on rent, you just can’t get any traction.”

There are other shared appreciation programs around the state. Douglas County Housing Partnership offers up to $70,000 in such assistance for eligible first-time homebuyers and has helped with 300 home purchases since 2005, investing a total of $7.25 million, according to Deputy Director Artie Lehl. Boulder’s Housing & Human Services office has helped with 90 shared appreciation purchases since 2000, each with a maximum investment of $100,000, according to Homeownership Manager Eli Urkel.

And in Denver, the Dearfield Fund for Black Wealth has distributed more than $8.2 million in down-payment assistance, helping Black residents buy houses. (The Colorado Trust made a program-related investment in Dearfield in 2021.) The Dearfield program acts like shared appreciation because homeowners don’t make monthly payments or pay interest. When a homeowner sells a house or refinances, the owner repays the down payment, plus 5% of the home’s overall appreciation.

HomesFund continues to evolve by raising money to offer new products, such as a construction loan program. The organization is also pioneering a first-mortgage program for nonconforming mobile homes and offers assistance for employees at Fort Lewis College and the local ski area Purgatory Resort.

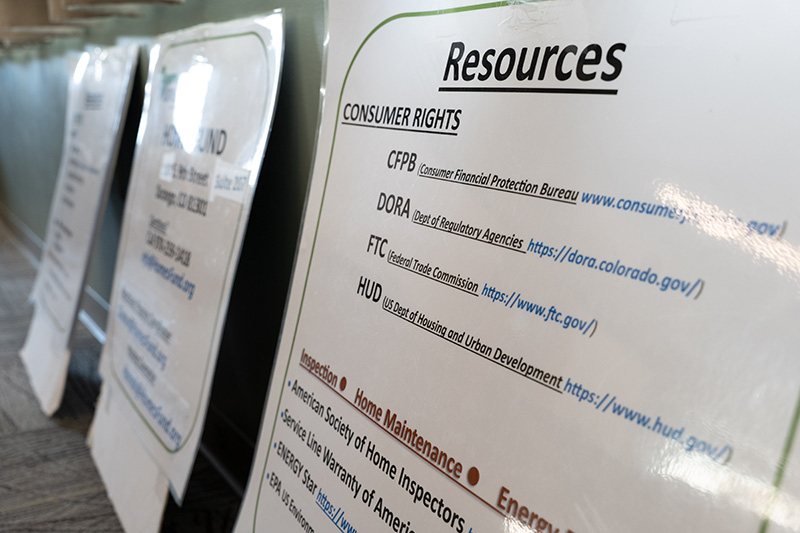

Participants of a HomesFund homebuyer education class were provided information about available resources, as shown in this photograph taken on Saturday, April 12, 2025, in Bayfield, Colo. Photo by Corey Robinson / Special to The Colorado Trust

According to Realtor.com, the median price for homes sold in Durango in July 2025 was $832,000. It’s lower for La Plata County as a whole ($675,000) and for many of the surrounding counties that HomesFund serves, including Archuleta ($640,800) and Montezuma ($355,000). About two-thirds of HomesFund’s activity is in La Plata County.

HomesFund was launched in 2008 with a $1 million grant from BP America as a way for the oil company to reduce housing costs to attract and retain employees. That seed money led to an initial batch of loans that established a track record of success. With the results in hand, the organizers applied for grants from the Colorado Division of Housing and the federal Community Development Finance Institutions Fund.

Today, HomesFund receives funding from local, state and federal resources. In January, the Colorado Department of Local Affairs awarded HomesFund $3.5 million from money collected via Proposition 123, a voter-approved initiative aimed at addressing Colorado’s housing affordability crisis.

When Moore started with HomesFund 14 years ago, loan amounts ranged around $15,000. Over time, those increased to $25,000, then to $45,000. In 2025, as housing costs keep soaring, it’s not unusual for HomesFund to grant a low-income buyer a $100,000 (or more) shared appreciation loan.

Using federally provided income data for each of the five counties it serves, HomesFund has income limits for prospective applicants that vary by household size. The nonprofit offers several shared appreciation programs as well as amortized loans for down payment assistance. Often, the nonprofit uses more than one funding source, so there is a stack of various loans. Borrowers are not eligible for programs if they earn above 150% of the area median income. La Plata County’s median household income is $85,296.

HomesFund will not finance any home purchase over $851,250 in the city of Durango or $699,500 in La Plata County. In Montezuma County, the HomesFund maximum purchase price is $350,250. The median home price in the prior year sets these prices.

Rolling paint on her living room wall on the first morning she and her husband took possession of their three-bedroom brick bungalow in downtown Cortez in Montezuma County, Autumn Sitton said the couple could not have afforded the $288,000 purchase without HomesFund funding a $30,000 shared appreciation mortgage.

Sitton and her husband both work for local sawmills. For months, the pair had been looking to move out of a nearby mobile home park.

“We didn’t have a yard or grass or anything,” said Sitton on her move-in day in March. “With the baby on the way, that was a big factor, too.” Without the HomesFund assistance, she added, they could have bought a house at a lower price, but it would have required significant repairs.

Autumn Sitton paints her living room wall on the first morning she and her husband took possession of their three-bedroom brick bungalow on Saturday, March 29, 2025, in downtown Cortez, Colo. The couple was able to purchase the home with the help of nonprofit HomesFund. Photo by Corey Robinson / Special to The Colorado Trust

Owning a house—even by sharing a portion of the future equity with HomesFund—feels like a better proposition than renting, Sitton said. “This is our home now, and everything we’re going to put into it is going to be our own.”

Back in downtown Durango on her April move-in day, nurse practitioner Whitney Mick unpacked boxes and organized the shelves in her kitchen. Mick and her 10-year-old son Charlie had been living across town with Mick’s mother and stepfather. Their new two-bedroom townhome is deed-restricted through a City of Durango program to build an inventory of affordable homes.

The townhome’s market value was $630,000. The calculated purchase price under the deed restriction was $311,000. The deed restriction means Mick can realize no more than 3% annual appreciation from the property. HomesFund assists in organizing raffles to sell deed-restricted properties. Mick’s purchase was the first time an initial owner resold a deed-restricted property.

Whitney Mick and her 10-year-old son Charlie pose outside their new two-bedroom townhome on the afternoon of Monday, April 7, 2025, in Durango, Colo. The home is deed-restricted through the City of Durango, and they were able to pre-qualify via the nonprofit HomesFund. Photo by Corey Robinson / Special to The Colorado Trust

Mick was not selected in one drawing in 2022 but pre-qualified through the HomesFund process, so she was ready to buy the deed-restricted property when it came on the market in 2025.

“I think [the deed-restriction program] is good because it gives hope for everybody,” she said.

Mick said earning a salary in the $80,000 range still makes finding an affordable home challenging. Housing prices “have gotten so steep here,” she added. “You can’t live here. It’s one of the top reasons why people move.”

HomesFund has served firefighters, court clerks, accountants, an assistant school principal, a professor at Fort Lewis College and an assistant manager at a local grocery store, according to Moore.

“If you have a two-adult household, but one adult is not working to stay home and watch the kids because child care is so expensive, that is a good profile of a household that could fit into our guidelines,” Moore said. “With home prices so high, funders realize that even those with higher incomes need help.”

No matter their income level, all HomesFund applicants must submit a detailed financial application to Sharon Carroll, the nonprofit’s homebuyer program coordinator, for review. Carroll examines their spending habits to determine whether the responsibility of a mortgage is within reach.

“We discuss needs and wants,” Carroll said. “They leave the appointment with a much deeper understanding [of] what they’re doing with their money and why they have had trouble saving. We teach them how to pay off debts and save.”

One woman, Carroll said, quit smoking on the spot to save money and qualify. In an uncomfortable counseling session, a wife discovered how much her husband had lost via online betting apps, leading to an important discussion about goals and financial planning.

Potential applicants who don’t immediately qualify are encouraged to take a few months to review their spending, follow the steps in an action plan, and return for a second (or third or fourth) appointment to receive the green light from HomesFund to be considered for down payment assistance. HomesFund does not keep track of the percentage of applicants who get accepted or rejected from the program.

“It’s like a personal finance gym,” Carroll said. “We get them into financial shape.”

HomesFund continues to create new products to help with the housing crisis, including the “First Mortgage Loan Financing for Mobile Homes with Land.” This loan has a 3% interest rate. Most traditional mortgage lenders won’t loan on mobile homes that have been moved more than once. Among other requirements for this program, borrowers must earn at or below 80% of the area median income.

HomesFund Executive Director Pam Moore poses for a photograph outside a HomesFund participant’s new home on Monday, April 7, 2025, in Durango, Colo. Photo by Corey Robinson / Special to The Colorado Trust

The program began in late 2024, but it’s already helped Chris Mitchell buy 40 acres and a double-wide mobile home near Ignacio in La Plata County. For the previous 21 years, Mitchell rented a two-bedroom mobile home on two acres for $600 a month. When the owner sold the property, Mitchell was forced to move.

Looking for a rental in Durango, the longtime construction worker faced the prospect of paying $1,500 monthly for a one-bedroom unit. A self-described “country boy,” Mitchell wanted land for his motorcycles and dog.

After finding HomesFund, Mitchell put together the required 5% down payment, and HomesFund provided both the first mortgage and a $28,000 construction loan for some required repairs to help him acquire the land and structure. Today, Mitchell is spending $1,400 a month on a three-bedroom modular home but also building equity for the first time.

“If I do something now on my place,” Mitchell said, “it’s the way I like it.”

Moore thinks the HomesFund model works in Durango because the concept is embraced by city and county leadership and the real estate community. But she recognizes that the HomesFund approach can’t solve everything.

“There has never been as much time, money and attention paid to housing issues in the area as there has been in the last two years,” said Moore, “because employers can’t keep employees. So, how can you grow a community if the businesses don’t have workers?

“The hard part is it just costs so much money to do anything around housing,” she added. “It’s an expensive problem. We are going to keep doing what we are doing, what we do well—providing affordable housing opportunities through finance and education.”