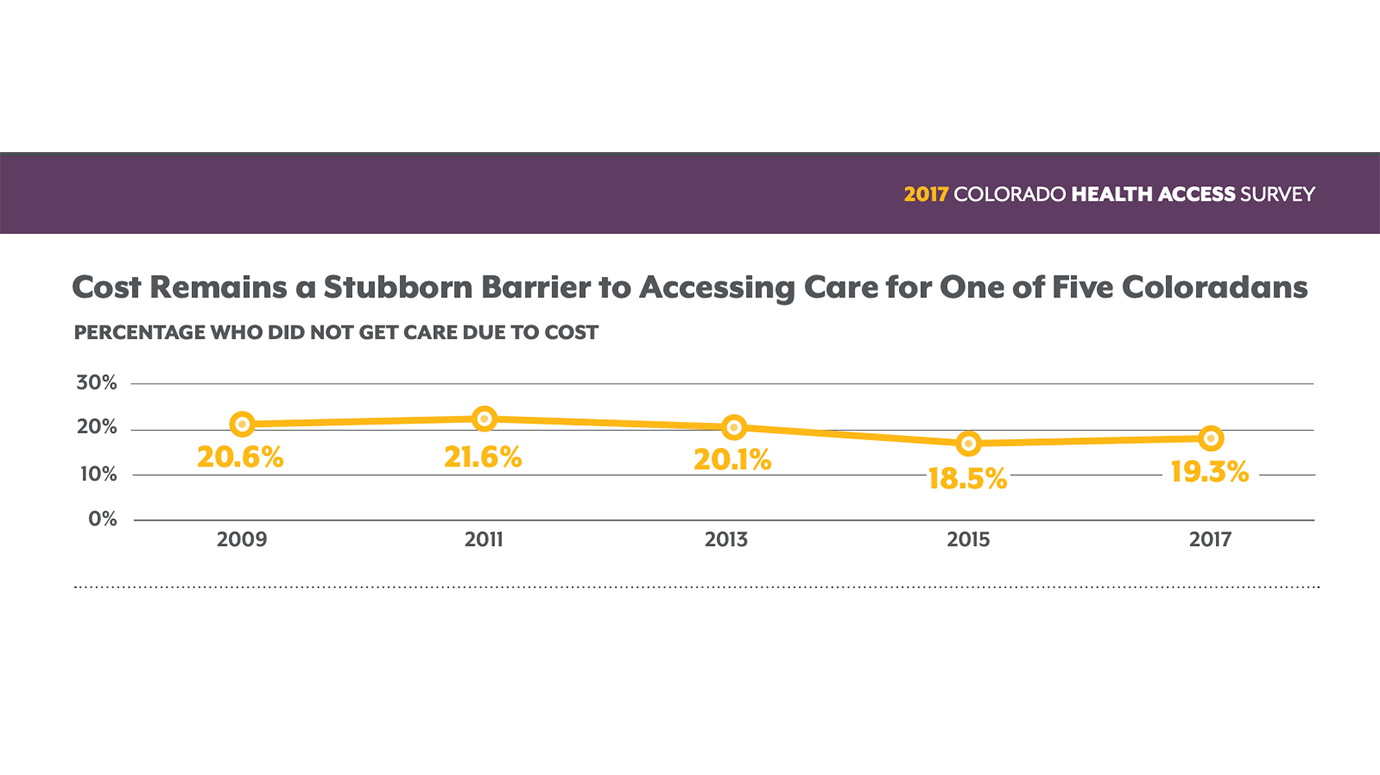

Despite big gains in coverage, nearly one in five Coloradans report skipping health care services over cost concerns—a figure that has barely changed over the last eight years. (Source: 2017 Colorado Health Access Survey results, p. 19)

Despite big gains in coverage, nearly one in five Coloradans report skipping health care services over cost concerns—a figure that has barely changed over the last eight years. (Source: 2017 Colorado Health Access Survey results, p. 19)

In 2011, 15.8 percent of Colorado residents did not have health insurance. By 2015, following implementation of the Affordable Care Act (ACA), just 6.7 percent of the state was uninsured.

This year, just 6.5 percent of the population lacked insurance. More people than ever before are covered, including more people from some groups that historically have been less likely to be insured: Coloradans with low incomes, young people and Hispanic Coloradans.

But that doesn’t mean that affordable health care or insurance is accessible to all Coloradans.

Especially in rural areas of the state, many people still report that they struggle to afford both insurance and health care. One in five Coloradans reported skipping some sort of medical care because of cost, and one in six Coloradans with low incomes reported spending more than 20 percent of their income on out-of-pocket medical expenses.

This is all according to the 2017 Colorado Health Access Survey (CHAS), the fifth iteration of a Colorado-Trust funded biennial survey that tracks Coloradans’ access to and experiences with health care and insurance. The CHAS results were released this week by the Colorado Health Institute (CHI), a Trust grantee.

At a press briefing on Monday, CHI Executive Director Michele Lueck said that the fact that the overall rate of Coloradans with insurance has stayed steady since 2015 is evidence that health policy changes in the past decade, including the ACA, are durable and providing more Coloradans with access to health insurance.

“Colorado has demonstrated that we’re holding our own in terms of implementing this major change in health reform and health and social policy,” Lueck said.

Marguerite Salazar, Colorado’s insurance commissioner, said that while she was happy more residents are insured, cost concerns and confusion over enrollment are still problems for too many residents. “The next frontier is how are we going to tackle health care costs,” she said.

Overall, there has been a drop in the number of Coloradans citing cost as the reason they don’t have health insurance: 88.4 percent of those lacking coverage said cost was the reason why in 2009, compared to 78.4 percent in 2017.

But income remains a major predictor of insurance status, and affordability remains an issue, particularly in rural Colorado.

While in affluent Douglas County, near Denver, just 1.4 percent of residents lack health insurance, 9 percent of Denver County residents are without insurance. More than 10 percent of residents in the rural southwest, northeast and southeast parts of the state are also uninsured.

And in rural northwest Colorado, 13.1 percent of residents don’t have insurance.

Jennifer Fanning, director of the Grand County Rural Health Network, a nonprofit in Hot Sulphur Springs, said that many of the uninsured in that region are not those who are eligible for Medicaid, but rather those whose earnings are above the federal poverty limit but who still can’t afford private insurance.

Much of western Colorado has access to just one private insurer on the insurance marketplaces, and premiums can be more than $1,000 a month for a high-deductible plan. Combine that with the high cost of living in some rural areas, and many insurance-seekers are in a financial bind: They aren’t eligible for significant government subsidies, but they simply can’t afford insurance.

Fanning said that she often hears people suggest that rural residents should find jobs to cover insurance. She said that doesn’t match the reality of life in Grand County: Many people are working several jobs, but they may be seasonal, part-time or at small businesses that can’t afford to provide insurance to their employees. Having non-traditional employment can make it challenging to navigate systems set up to help people find insurance, Fanning said.

That reality isn’t unique to rural Colorado. Statewide, for the first time, fewer than half of CHAS respondents this year reported receiving health insurance through their employers. And 9 percent of employed Coloradans said they don’t have insurance.

Fanning said she knows that making health care more affordable in rural Colorado and throughout the state is a complex task. But in the meantime, many rural Coloradans are going without insurance or, sometimes, without health care.

In Fanning’s case, the challenge isn’t theoretical. This year, Fanning’s husband opted out of buying health insurance.

“I run a health network… but we can’t afford it,” she said. “Certainly, I’m not saying, ‘do this’—but these are the decisions our community is having to make.”

Other notable findings from the 2017 CHAS: