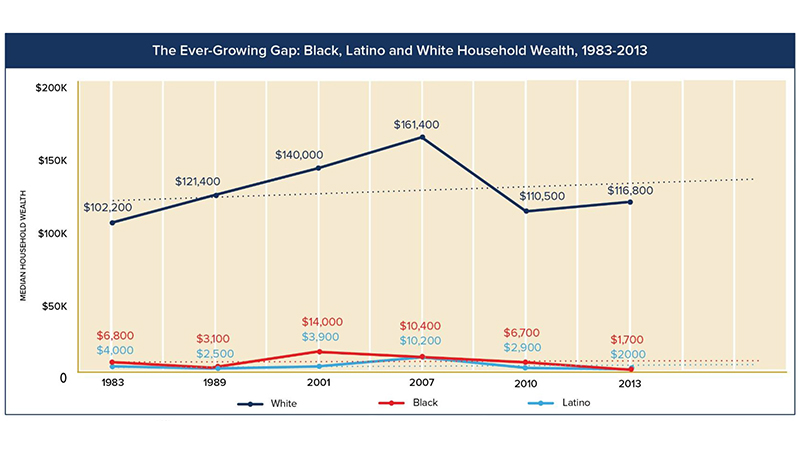

New research finds that disparities in household wealth between whites and people of color have persisted for years, and recently worsened. (Source – p. 8)

New research finds that disparities in household wealth between whites and people of color have persisted for years, and recently worsened. (Source – p. 8)

Racial inequality in the United States—a country with a long, deep history of racism—is nothing new.

Two new reports highlight ways in which the divide between white and non-white Americans has grown in recent years—and what that spells for the future of America.

In The Road to Zero Wealth: How the Racial Wealth Divide is Hollowing Out America’s Middle Class, a report published by the left-leaning organizations Prosperity Now and the Institute for Policy Studies, the authors examined the fact that an increasingly disproportionate share of the nation’s wealth is held by whites—a phenomenon known as the “racial wealth divide”—and what policy interventions could reverse the trend.

In an attempt at reconsidering what it means to be middle class, the report analyzed 30 years of data on wealth, rather than income.

“Wealth is what allows households to ride the ups and downs of the economy successfully or unsuccessfully, and to take advantage of economic opportunity,” said Dedrick Asante-Muhammad, a co-author of the study and a senior fellow at Prosperity Now. Income, on the other hand, reveals only a sliver of a typically complex socio-economic picture, he said.

Results showed that in 2013, the median wealth of white households was $134,000, nearly 10 times the median wealth of Latino households ($14,000) and more than 12 times the median wealth of black households ($11,000). It’s a gap that has only widened over the decades: between 1983 and 2013, the median wealth of black and Latino households dropped 75 percent and 50 percent, respectively, while median white household wealth rose by 14 percent.

If the middle class were defined by wealth rather than by income, the report found, black and Latino families in the middle-income quintile would need to earn two to three times as much as white families in order to enter the middle class.

“We’re seeing the physics of advantage and disadvantage,” said Chuck Collins, study co-author and director of the Program on Inequality at the Institute for Policy Studies. “Those who already have access to wealth are able to propel their own children forward, and the opposite is true for the disadvantaged.”

These circumstances can trigger wider systemic inequality.

“The foundation of racial inequality is racial economic inequality, and the foundation of that is the racial wealth divide,” said Asante-Muhammad.

As the percentage of people of color in this country grows, the economic instability that has been concentrated in black and Latino communities will soon represent a larger portion of the American population. That, in turn, will spell insecurity for—and erosion of—the American middle class, the researchers asserted. Without a significant shift, the report warned, the country is barreling towards “a racial and economic apartheid state.”

These underlying demographic changes were the focus of a separate report by the national research and advocacy institute PolicyLink. In Bridging the Racial Generation Gap Is Key to America’s Economic Future, the authors examined the growing racial divergence between America’s youngest and oldest generations, known as the “racial generation gap.”

In 1975, the report found, 13 percent of seniors were non-white, compared with 25 percent of youth. Throughout the next four decades, overall diversity increased, but the shift occurred much more rapidly among youth. By 2015, 22 percent of seniors were people of color, compared with 49 percent of youth.

The problem with this widening gap, said Manuel Pastor, PhD, study co-author and professor of Sociology and American Studies & Ethnicity at the University of Southern California, is that it creates “a polarization that stems from the older generation looking at the younger generation and not seeing itself.” (Pastor is a past speaker from The Trust’s Health Equity Learning Series.)

This disconnect impacts public policy, and a prominent social determinant of health: counties with a higher racial generation gap tend to spend less on K-12 education on a per-capita basis.

But the gap doesn’t just impact education, said Pastor. It translates into an attitude of “the older generation wanting to lift up the drawbridges just as a new generation is arriving,” he said, citing the fact that nationally, there is “plenty of commitment to Medicare and Social Security protection, but not as much for education and health care for the young.”

As the future of the country depends on the vitality and productivity of the young labor force, Pastor added, the gap is “very worrisome.”

“If we don’t deal with this issue quickly, the fraction and polarization that has increasingly defined the U.S. will just grow,” he said. “It’s pretty clear that is leading to dysfunction. We’ve avoided it, and I hope that changes.”

For both the racial generation gap and the racial wealth divide, solutions begin with both recognition and discussion of the issues.

“We’re very uncomfortable talking about race in the U.S.,” said Pastor. “Some people believe that the way you tackle racial difference is to not talk about it, but focus on common issues and work together to forget this stuff.”

But a more helpful approach, he said, is to “lift up the dimensions of race and age.” This means helping older Americans to “think more carefully about who we are together,” while also encouraging the younger generation to “consider the dimensions of age when thinking about racial hostility and how to deal with it.”

Beyond that, it’s a matter of altering public policy. Pastor and co-authors of the racial generation gap report recommend linking together public policies to foster more intergenerational contact, like creating better working conditions for the younger, oftentimes immigrant workers who care for the elderly; or developing school-based programs in which older community members mentor students on professional skill-building. They also see promise in implementing school funding policies at the state level that better target those who need assistance.

To combat the racial wealth divide, Prosperity Now urges lawmakers to shift the national tax code to benefit low-wealth families of color rather than subsidizing the already-haves. This could include reforming the mortgage interest deduction, expanding the federal estate tax and introducing net-worth taxes on multimillion dollar fortunes. (Admittedly, little of this appears likely in the current political climate; an ambitious tax reform plan now under debate in Congress would significantly cut taxes for the wealthy and corporations.)

“This isn’t insurmountable,” said Collins of the Institute for Policy Studies of the racial wealth divide. “The trajectory is a little bit scary, but we could quickly shift it.”